The current adoption of short-term content is absurd. On Oct 2022, Meta CEO Mark Zuckerberg said that more than 140 billion Reels play daily across Facebook and Instagram (marking a 50% increase from six months ago). On Feb 2023, Google declared in their financial statements that today they have 50 billion daily views on Youtube Shorts (marking a 66% increase from twelve months ago).

On February 1st, Youtube officially rolled out the Youtube Shorts monetization program to the Youtube Partner Program (YPP). It mimics Youtube’s long-form content’s revenue-sharing features where creators will earn 45% of the allotted revenue from advertisers; however, there are many differences between Shorts and long-form content, given the complexities associated.

Today we will talk about

Youtube Shorts monetization programs mechanics

Comparison with TikTok Pulse monetization program

The Impact Shorts have on Creators and the Youtube Ecosystem

As usual, I included a list of reading recommendations if you are interested in learning more about the creator economy and three creator economy startups that I’m paying attention to!

Youtube Shorts Monetization Programs Mechanics

Before 2023, you couldn't make money on YouTube Shorts in the traditional sense. There was a $100 million YouTube Shorts Monetization Fund, where Youtube distributed bonuses ranging from $100 to $10,000 to top creators. However, the incentives don’t align with creators, as the revenue pool is capped. The new monetization program will replace the Youtube Shorts Fund.

The Youtube Shorts Monetization Program is inherently complex for many reasons. Firstly, we have many stakeholders to align with. We have (i) creators, (ii) users, (iii) advertisers, (iv) music partners and (v) platforms. Each of them is critical in building an ecosystem on Youtube and must be aligned to develop a self-sustaining ecosystem. Secondly, there will not be any pre-roll, mid-roll, or post-roll ads that are directly attributed to a single creator. Instead of seeing 2-3 ads per video published by a single creator, you will see ads in between shorts. Therefore multiple creators will share the dollars invested in the ad. Thirdly, geography matters. Ads spent on North American audiences differ dramatically from ads spent in Southeast Asia.

As a result, Youtube developed its monetization program with the following features:

45% of the ad dollars will be aggregated into the creator pool and distributed to creators based on (1) eligible view counts and (2) the audience's geography.

When creators upload Shorts with licensed music, YouTube will split the revenue between the Creator Pool and music partners based on the number of tracks used.

In practice, here’s an example of how this works (created by Team Youtube)

As a monetizing creator, let’s say you upload a Short that uses 1 music track. Here’s how we’d calculate what your Short earns in Country A this month.

There are 100 million total Shorts views in Country A, and all views are on Shorts uploaded by monetizing creators. $100,000 is earned from ads that play between Shorts in the Shorts Feed. 20% of these Shorts use one music track, so the Creator Pool is $90,000, and $10,000 is used to cover the costs of music licensing. Your Short is viewed 1 million times, so you are allocated 1% of the Creator Pool, or $900. Your allocation from the Creator Pool is not affected by your use of a music track. The 45% revenue share is then applied to your allocation, and you earn $405 for your Shorts views in Country A.

A few questions raised from me which are:

(1) What is considered an eligible view?

According to Colin & Samir, Youtube has an undisclosed time threshold for examining Shorts eligibility. In addition, Youtube guideline distinguishes the types of ineligible videos, including (1) unedited clips from movies, sports games or TV shows and (2) other creators' content from YouTube or other platforms, with no original content added

(2) If Youtube only considers view counts, how about engagement?

The monetization regime doesn’t include engagement as part of the distribution metric, likely because engagement is an endogenous variable that is closely related to viewing counts, which could result in double counting, and it will also expose to bot/spamming issues.

However, engagement is core in Youtube Shorts' algorithmic feed design. Any like, comment, share, and replays will provide positive feedback to the algorithm to include more similar videos by the creator. As a result, increasing eligible view counts for that creator.

Comparison with TikTok Pulse monetization program

TikTok

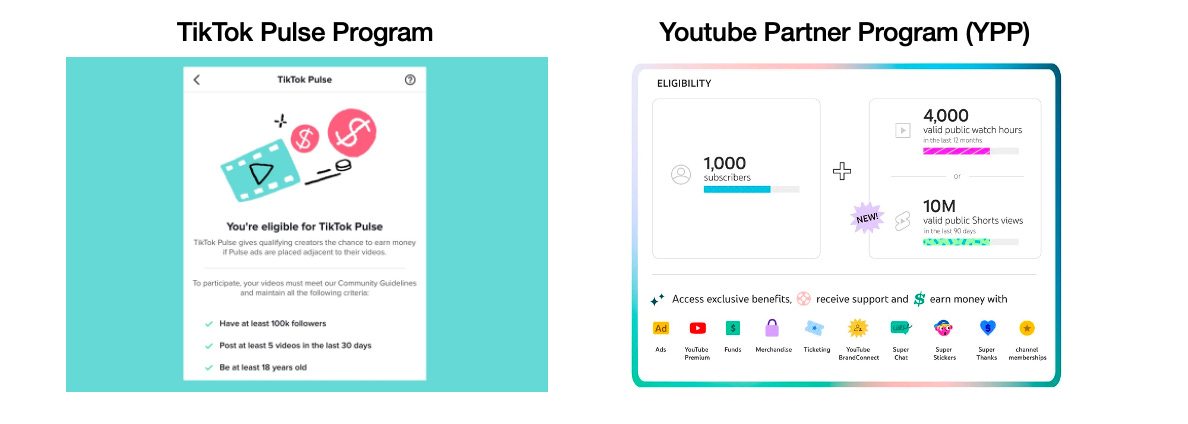

To be eligible for TikTok Pulse, you must satisfy the following:

Have at least 100k followers

Post at least 4 videos in the last 30 days

Be at least 18 years old

Eligible creators will receive a 50% split of ad revenue from TikTok. Brands will put ads on TikToks that are in the top 4% of performers on any given day Creators get 50% of the revenue TikTok brings in from the brands. TikTok is only available in the United States but not in regions outside the US.

Youtube

To be eligible for Youtube Partner Program (YPP), you must satisfy the following:

Have at least 1000 subscribers

Accumulate at least 4000 valid public watch hours OR 10 million public Short views

45% of the Ads dollar spent on Shorts ads will be allocated to the creator pool after music partners have their shares. Every creator will be rewarded according to their propositions of the total eligible view count.

—

Here are some of the key differences I noticed between the two:

TikTok monetization favours mega / top-performing creators, whereas Youtube rewards everyone who meets the YPP requirements.

Youtube is rolled out internationally with audience geographies taken into account, despite both platforms having tremendous presence across the world outside of the United States.

It is almost a “hit or miss” for TikTok creators to earn sustainable revenue from the platform, as they must perform at the top 4th percentile to receive a payout, making it incredibly difficult for middle-class creators to achieve.

The Impact Shorts have on Creators and the Youtube Ecosystem

Implementing the Shorts monetization program means that Youtube is no longer a long-form video platform but a video platform that includes content of all sizes.

Shorts are likely to increase watch time on Youtube as a whole and will likely cannibalize watch time for long-form videos. However, it is also important to realize shorts are inherently a different content medium/vehicle than long-form videos.

Shorts are the best for discovery when creators want to reach new demographics or experiment with new ideas with low friction. Shorts are the best for content curation, including reaction videos, repurposed clips from long-form videos and trend-mimicking videos (i.e. dances/skits). However, shorts are not great at building communities because when consuming short-form videos, most users focus on the content (the feed), and very few focus on the creators themselves. Therefore, we saw a lot of TikTok creators gradually migrate to Youtube to build a community.

In the future, Shorts will continue to integrate with Youtube’s existing ecosystem with long-form content and music. After the expansion of the YPP monetization program, Youtube will likely make continuous improvements to the algorithmic feed and introduce new tools for a more seamless in-app editing experience for aspiring creators. We will continue to see a user-turn-creator pipeline on Youtube, like how it happened on TikTok.

I would be paying lots of attention to the payout differences between creators with audiences across geographies, how TikTok Pulse will react to this monetization program, and how likely Youtube Shorts can catch up with Reels in international arenas.

--

Recommended Readings about Creator Economy

We interviewed YouTube employees about Shorts (Creator Support)

John Fio - Creating Magic for Consumers (Invest Like The Best)

Youssef Ahres, Co-Founder & CEO of Flagship (Digital Native)

Meet Artifact, a kind of TikTok for text by Instagram Co-Founder (Platformer)

Is TikTok losing the Hype? (Accelerated)

Elon says that Twitter will start sharing ad revenue with creators ‘today’ (TechCrunch)

Tiktok's enshittification (Heating Buttons) (Pluralistic)

BuzzFeed to Use ChatGPT Creator OpenAI to Help Create Quizzes (WSJ)

Social Media Platform Updates 2023 (Social Navigator)

Film School for Creators Startup Creator Now Raised $3M (Twitter)

Hank Green launched called an EdTech Study Hall that allows students to earn college credits, in partnership with Arizona State University and YouTube (NBC)

Top Startups You Should Pay Attention To

Creable (PreSeed, Led by Sequoia)

Creable is an all-in-one platform for brand deals. It enables creators to work seamlessly with brand representatives, from communication bookings to work portfolio set-up and video collaborations to performance analytics. Founded by Daniel, who was a full-time gaming Youtuber in 2009 and also founded Yxterix, the largest Swiss-based influencer marketing agency.

Bonus: If you are interested in hearing Daniel’s ideas on the creator economy, feel free to check out our episode with Daniel dated September 2022.

Flagship (Seed, Sequoia Capital, Index Ventures)

Flagship is a simple platform for creator entrepreneurs to build their online storefront boutiques. Flagship allows creators to customize the online shopping experience for their community, in addition, both original and affiliated products are featured in the storefront, allowing commissions to be earned for creators when they work with larger brands. Co-Founded by Youssef, who was the director of data science at Instagram before founding the company.

roster (No Fundraising Record To Date)

Roster is a marketplace for on-demand video/podcast editors, scriptwriters, producers and more. Currently, Roster is working with creatives that work with top creators like Dude Perfect, Nas Daily, Jenn Im, Mark Wiens, Ali Abdaal, and Real Science. Founded by Sherry, who is a serial entrepreneur working with creators and runs a Youtube Channel herself.

Super helpful piece! Do I have it right that YouTube's 45% is for all Shorts ad revenue, while TikTok's 50% applies to only the subsegment of TikTok revenue that's in the Pulse program? (Do we know what portion of revenue is in the Pulse program?)