Social Tokens Don't Work, Here's Why

Social token sits at the intersection of crypto and creators. It remains a controversial topic among investors, creators and fans. Many startups like Roll, HumanIPO, Calaxy, Rally are working on creating the token and exchange infrastructure for creators.

“A new cultural mindset around ownership is colliding with new technology. We’re on the precipice of the third era of the web”

Rex Woodbury, Partner at Index Venture on The Atlantic

Today, we’ll cover

What does Social Token mean in financial terms

Equity is the most expensive form of capital

Emotional distress when creators are tied to monetary value

What is Social Tokens? ($ALEX Example)

The most common form of social tokens is Income Sharing Agreements (ISAs) on the blockchain. The best example of that is Alex Masemej, who was the first to issue social tokens that worked.

In April 2020 Alex sold ‘shares’ of himself to raise $20,000 to help get him from Paris out to Silicon Valley and pursue his entrepreneurship goal. Initial holders of $ALEX were entitled to 15% of his income for the next 3 years, capped at $100,000. There were also other privileges such as 1/1 interactions, intros to his network and retweets. Today Alex founded an NFT company, Showtime, and raised $7.6m in April of this year to continue building out the NFT social network.

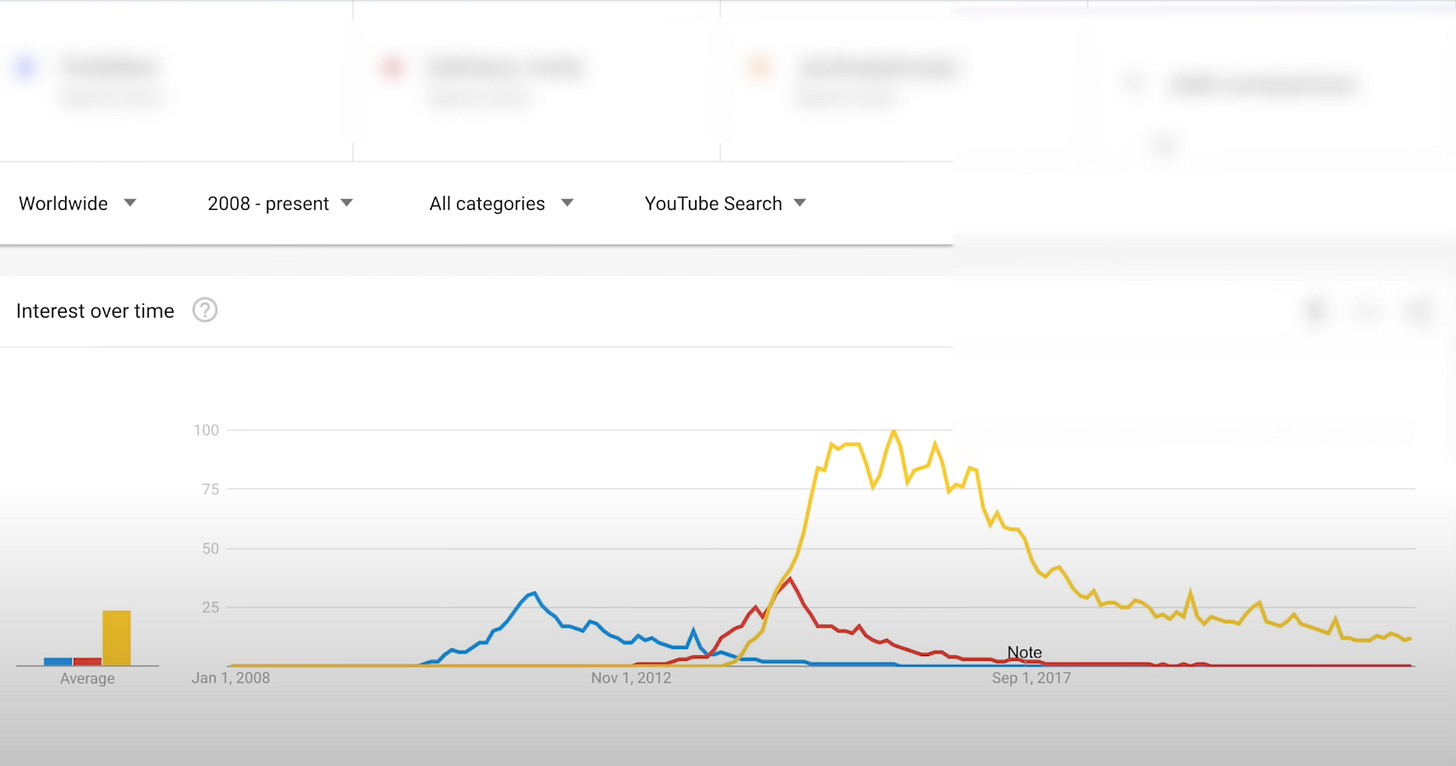

In short, social tokens represent the equity of an individual’s earning power. When creators like Alex will restrict the ISA with a time window and income sharing limit, the ISA essentially turned into a zero-coupon bond with limited return opportunity. As a result, there are no long-term gains to be realized (See graph above)

Equity as the Most Expensive Form of Capital

Investing in creators seems to be an attractive opportunity, but before we get into it, there are two questions that we need to address

Who are we building for?

Are there better forms of monetization mechanisms out there?

Up until today, there haven’t been ANY large-scale influencers or celebrities that embraced the idea of ISA social tokens. If you scroll through the 421 social tokens TryRoll launched, most individual tokens are launched by investors/authors to experiment with the platform, without an ISA with their future earnings.

ISAs are not built for large creators, because they don’t need to give up future earnings for cash upfront. They can easily finance brand deals and merchandise without risking their reputation by issuing social tokens. In addition, taking on loans is also much more attractive to creators from a financial point of view. Because in the end, equity is the most expensive form of capital.

ISA social tokens can apply to amateur creators starting out who don’t have access to credit facilities. It works but at a huge cost. Most creators would much rather fundraise on a project basis (i.e. film/literature fundraisers from Kickstarter) or work part-time to generate cash flow to support their side businesses instead of issuing social tokens, not because of the complexity of it, but for the unfavourable economics.

Creator Lifecycle

Investing in lifetime equity knowing creator careers are usually within 3-5 years does not make sense. Creators usually leverage social media to build a presence and subsequently build businesses/agencies to diversify their income outside of platforms.

At Creator Dynamics, Matt Koval revealed that most creators lost relevance within a few years, which is alerting from an investor standpoint - it is impossible to project future cash flow or the longevity of the channels run by the creators.

Emotional Distress

What happens if the value of the creator token goes down? What happens if the community start fudding about it? What if the creator wants to take a break?

Many creators are actually aware of the implied responsibilities behind launching a social token - moderating and growing a community of people, which takes a vastly different skill than creating content. From the logistics of creating a community to the constant communication required to keep everyone informed about things. The creator-follower relationship will slowly turn into a founder-investor relationship, which can be difficult for creators to navigate through that.

A creator’s purpose is to create, not fundraise. Despite Social tokens can relieve immediate financial struggles, it has longer-term complications. It will cost mental energy, a portion of future earnings and reputation.

💡 This Week's News In the Creator Economy

Adobe acquired digital design app Figma for $20B

Tagger, an influencer marketing platform raised $15M Series B

South Korea issued an arrest warrant for $LUNA founder Do Kwon

Patreon laid off 17% of its workforce, affecting 80 employees

TCG is investing $100M into Night Capital to invest in macro creators

TikTok US faces scrutiny from congress

TikTok launched a BeReal-like dual camera feature

Khaby Lame revealed how much is he getting paid per post

✌️ That’s it until next time!

If you have this helpful, please subscribe for more content surrounding the creator economy. I’d love to engage and collect some feedback if you have any ideas, my DMs are always open!

Thanks for reading Creators Lab 📸! Subscribe for free to receive new posts and support my work.