Is TikTok Going To Be a Spotify Killer?

From launching its own talent management branch to streaming app, whats up with TikTok lately?

Hi, I’m Alex, the author of Creators Lab and a strategy consultant focusing on technology. Creators Lab sits at the intersection of social, commerce and media. We help educate people who are interested in learning more about the fundamental concepts and forces that are driving the creator economy.

This summer, TikTok has ramped up its effort in the music industry, with the introduction of Elevate, a cohort discovery program to build a roster of artists in partnership with Warner Music Group. In addition to its own music streaming app (now available in Australia / Mexico / Singapore), what does it mean to Spotify and the music industry?

Today we will talk about

TikTok’s Recent Development in the Music Industry

TikTok’s Opportunities to build market share in the streaming industry

Unaddressed questions surrounding the music industry

TikTok’s Recent Development in the Music Industry

TikTok’s core product is its algorithmic feed which prioritizes interactions with content rather than interactions with creators. TikTok wants to extend that and make TikTok a social platform by introducing DMs and Stories where users can communicate with one another, however, there is a problem.

People are already well-connected on Instagram and they don’t have any problems with it, why would you do it all over again on TikTok? This alludes a little bit to TikTok-to-Spotify’s case as well.

Back to TikTok’s recent development in the music industry, they have done a lot of work behind the scenes that users may not notice easily.

Firstly, TikTok has partnered up with Warner Music Group to develop a talent program, called Elevate, it’s meant for TikTok (and Warner) to identify and amplify emerging musical artists.

Secondly, TikTok also expanded its licensing agreement with Warner Music Group to provide tunes for TikTok, TikTok Music, CapCut and TikTok’s Commercial Music Library. Meaning the continuing relationships between Warner and TikTok could one day be used against Spotify with content exclusivity if TikTok can financially support Warner Music Group better than Spotify does.

Lastly, enter TikTok Music, the new streaming application which is now available in Australia, Mexico, Singapore, Brazil and Indonesia.

TikTok’s Opportunities to build market share in the streaming industry

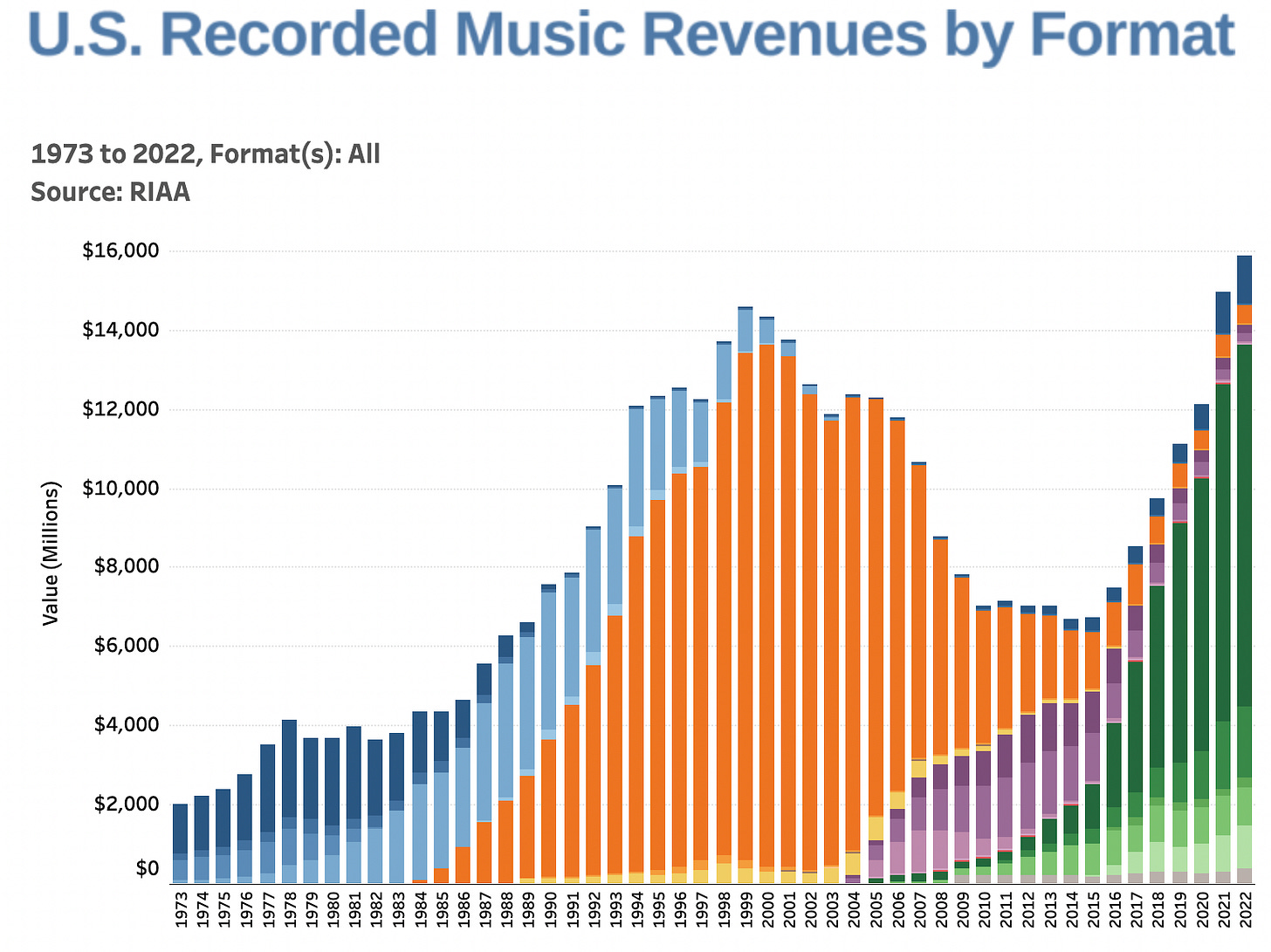

Over the last 4 years, Spotify’s market share has fallen 6% from 36% in 2018 → 30% in 2022, primarily driven by the expansive effort by Tencent Music and Youtube Music, the music streaming industry is becoming more competitive. At the same time, online streaming has become a $9.2 billion market, representing 57% of the music industry.

There are 3 Opportunities TikTok could pick up to combat Spotify.

Music Exclusivity

Music exclusivity means albums and songs available on TikTok Music but not Spotify. It happens in various forms, from exclusive early releases on TikTok only to artists denying to stream on Spotify but only on TikTok music. The key to music exclusivity is to label relationships - aka TikTok’s relationships with musicians’ talent firms.

With TikTok’s ongoing licensing expansions with Warner Music Group and its 30 music corporate partners, it shows that TikTok has developed deep industry relationships with labels and studios. TikTok even has a team focused on Music efforts since its inception.

On the other side, TikTok has a looser content community guideline which enables user-generated remixes to be uploaded and used on TikTok. It will allow more variety of music to be available on TikTok but not Spotify. Another argument can also be made with TikTok’s ability to publish Asian-made music because of its greater cultural relevance in Asia. TikTok could be advantageous in signing and streaming Chinese / Indonesian musicians as these markets are one of the most populous regions in the world.

Synergies with TikTok

Imagine the songs you favourite on TikTok are effortlessly saved for you in TikTok Music, and your friend list is ported over too. Plus, the “For You” feed of personalized song recs can be trained on your activity in both apps.

There are a few areas that are clearly differentiated compared to Spotify.

For You Song Previews - TikTok’s algorithmic feed but for audio discovery

Network Import - Importing the followings from TikTok

Music from Saved TikToks - Syncing saved TikTok audio libraries to a new app

These are structural advantages TikTok has over Spotify. Similar to Youtube launching Shorts as a strategy against TikTok but TikTok could not replicate long-term video searches against Youtube.

Network Effects

Spotify is deeply integrated to pop culture with its robust partnerships with artists, annual wrap up and history. Lack of a better term, Spotify is a huge part of North pop culture in North America and Europe, which is a competitive advantage but not a self-sustaining one.

With time, TikTok Music could slowly build up a social presence in regions where they operate, especially in Asia, where Spotify doesn’t have a predominant cultural influence. Success for TikTok Music means international growth, not necessarily anchored around the North American market.

(In fact, TikTok launched a streaming service named Resso in India and Brazil early in 2022 and had great tractions with usage)

Factors To Watch Out For

TikTok’s ability to execute the rollout is highly dependent on its ability to build industry rapport with music labels. For example, with its partnership with Warner Music Group. However, there are instances where major labels like Sony Music where TikTok isn’t able to compensate artists properly which led to withdrawal from Sony Music-managed artists.

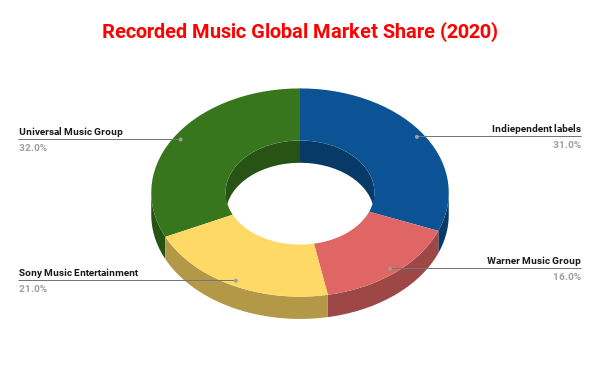

The top 3 labels (Sony Music, Universal Music and Sony Music) together represent over half of the music recording (68%) and music publishing (58%) market. The conversations between TikTok and these labels could have a major influence on content availability, which could immediately impact the user experience of the new music streaming application.

Another factor is brand. The brand is undeniably one of the most important parts of a successful consumer app (i.e Spotify, Duolingo, Grammarly), a successful consumer application could sustain itself without inorganic (paid) acquisitions because they have a great brand (and Word-Of-Mouth) which generates organic traffic.

TikTok’s notorious reputation for its affiliation with Bytedance is very hard for happy Spotify consumers to ignore. The tension between Western countries and the Chinese governments is tightening over time. Although the switching cost is not as high as social media or finance applications (fairly low), TikTok would need to be very innovative to deliver a magnitude more value to consumers to justify the switch.

This Month in the Creator Economy

Streamy announces creator nominees for their 13th annual ceremony (Streamy)

Nas Daily launched Nas Travel, a cohort-based travel community (Nas Daily)

NASA is planning to launch their own streaming platform, NASA+ (Engadget)

FaZe Clan considers offers from Gamesquare and Enthusiast Gaming (SBJ)

TikTok introduces “text posts”, mimicking threads and Twitter content (TikTok)

Alphabet revealed Q2 earnings release, Youtube revenue rose 4% YoY and Youtube Shorts viewers increased from 1.5B last year to 2.5B (Alphabet)

Spotify recorded higher monthly active users but lower cash flows (Spotify)

Twitter rebrands itself to X (x.com Twitter)

Ali Abaal published its first book “Feels Good Productivity” (Youtube)

Top Startups You Should Pay Attention To

Motion App (Series A, Led by Headline Ventures)

Motion App is performance measure software built for creative teams. Founded in Jan 2021 by Reza Khadjavi, Motion aims to help creative teams quantify the impact of their work, from managing analytics from social media engagement to influencer marketing conversions to workflow design and delegation.

Dare Drop (Bootstrapped)

Dare Drop is a software that serves game publishers to engage gaming creators & their fans through gamified challenges. Founded in 2018 by Joe Bechtold and Paul Traficanti, Dare Drop allows game publishers and fans to make dares to creators in order to deepen their relationships and create communities around their own games.

Flavrs (Seed, Led by Andreessen Horowitz)

Flavrs is a video shopping platform dedicated to food content. Founded in 2020 by Alejandro Oropeza and Francois Chu to curate better watching and shopping experiences for consumers who are interested in food content. It helps food creators to monetize recipes, and sell custom food packages while streaming the buying process from watching (from an algorithmic feed) to checking out.