5 Things You Need To Know About Threads

Hi, I’m Alex, the author of Creators Lab and a strategy consultant focusing on technology. Creators Lab sits at the intersection of social, commerce and media. We help educate people who are interested in learning more about the fundamental concepts and forces that are driving the creator economy.

It took 5 days, for Threads to reach 100 million signups. This surpasses the previous record held by OpenAI’s ChatGPT, which took 2 months to accomplish the same feat.

There is no advertisement, no DMs, no feed nor explore sections. It is still an early product with lots of work to do, however, the value proposition remains unclear to most of its users.

In this article, we will dig through the story and ongoing discussions about Threads.

Today we will talk about

3 Key Factors Driving Thread Explosions

2 Major Differences between Twitter and Threads

The Race To The Top Right Corner

3 Key Factors Driving Thread Explosions

In March 2023, there was a reported leak of Meta working on a “Twitter Clone”, a text-based social app that is codenamed as “P92/Barcelona”. P92 (known as Threads) is going to further develop Meta’s family of apps, where Threads will have complementary effects to the rest of Meta’s platforms.

The Meta team has demonstrated product excellence with regard to Threads. Three major points I would like to highlight:

Moving Fast and Breaking Things

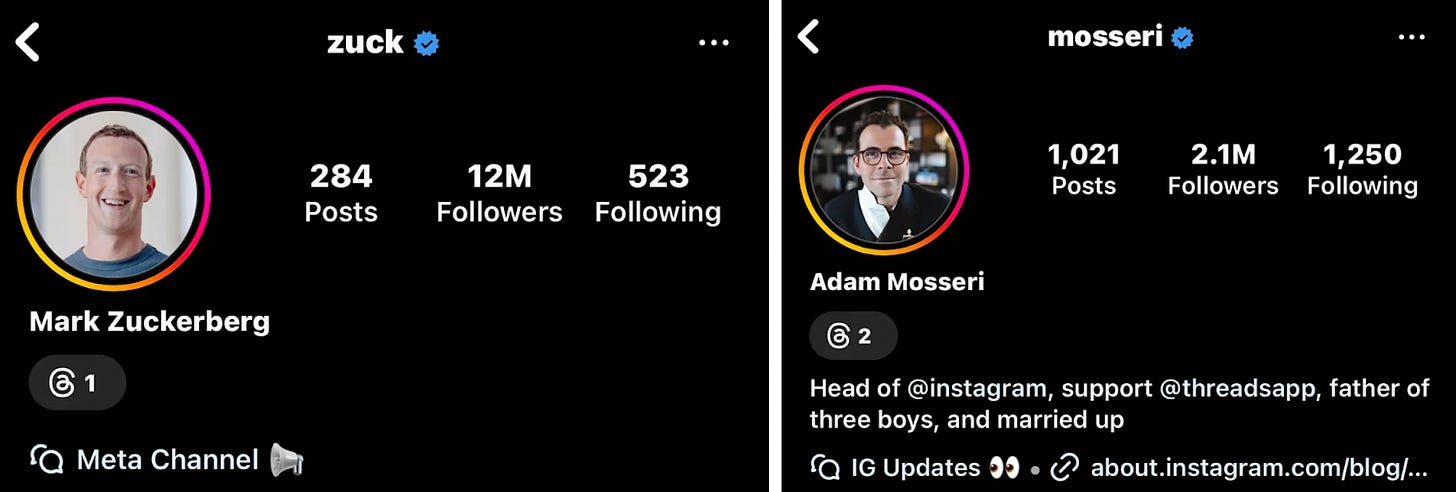

Before launching Threads, Meta has already considered incorporating text into the core Instagram app. Mosseri (CEO of Instagram) commented that they have tried doing that. But everything they tried felt forced, and out of place. The thing that makes Twitter distinctive is that replies are given the same visual priority as the original posts. In a world where every other social network buries comments underneath posts, Twitter elevates them. And that encourages people to participate in discussions.

Before Thread was even developed, Meta has attempted different ways of incorporating text-based conversations in Instagram, to come to the conclusion that they should develop Threads as a separate app.

Launch timing corresponding to Twitter

On July 1, 2023, Twitter introduced rate limits where users would have an upper limit on the number of content they could consume on Twitter. It has sent a fresh wave of Twitter users looking for alternatives.

With the information, Meta pushed forward the launch date of Threads from 10 am EST on July 6th to 7 pm EST on July 5th, to capitalize on the negative sentiments people have about Twitter.

Seamless onboarding and virality loop

Meta leveraged Instagram by integrating it with Threads, users can seamlessly import their follower list, thereby expanding their reach and accumulating followers on this new platform.

Furthermore, Threads introduces a badge on users’ Instagram bios, displaying a number that indicates how quickly they joined the app after its launch. This feature adds a sense of exclusivity and urgency to the platform.

Meta also sent select influencers and brands an “early access” guide to test Threads. The same pattern occurred when Instagram was just launched, where the founders Kevin Systrom and Mike Krieger heavily focused on acquiring influencers on the platform whereas their fans will follow them to whichever platform they go to.

Threads and Twitter: Two Major Differences

The Perception of a Town Square

Mark Zuckerberg and Elon Musk have varied views on what a town square looks like.

According to Mosseri, “The goal is to create a public square for communities on Instagram that never really embraced Twitter and for communities on Twitter that are interested in a less angry place for conversations.”

For Musk, he commented that “The reason I acquired Twitter is that it is important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner, without resorting to violence.”

In Zuck’s view, Threads is an extension of Instagram where creators can further engage with their audience through text. Threads would become a common place where people would have public conversations in a “less angry” environment. In Musk’s view, Twitter exists to serve the public conversation, on both information and entertainment, from politics to memes.

Pressure to Monetize

Twitter has the pressure to turn around and become cash flow positive whereas Meta does not have the pressure to monetize Threads anytime soon.

In fact, one of the major key success factors behind the acquisition of Instagram and Whatsapp was the removal of the pressure to monetize immediately. In 2014 during their last fiscal year, Whatsapp recorded $16 million in revenue and a $26 million net loss. Meta’s acquisition of Whatsapp allowed the company to continue to focus on product development and distribution without immediate needs for achieving profitability. Whatsapp was not properly monetized until 2018 and 2020 when Meta rolled out the Business API communication services and payment features. Whatsapp had the privileged to focus on products without immediate monetization needs when operating under the roof of Meta.

Twitter, on the opposite end, suffered from financial obligations. Rent, consulting, and software vendor, in addition to the $1.5 billion annual interest on the $13 billion debt Musk financed to acquire Twitter. Twitter is strongly incentivized to reduce operating expenses and monetize as soon as possible. Thurs, Musk would deploy various strategies (i.e. rate limits) to maximize Twitter Blue subscriptions in order to alleviate their financial situations.

The Race To The Top Right Corner

(Ben Thompson wrote a great piece about the state of the social media applications)

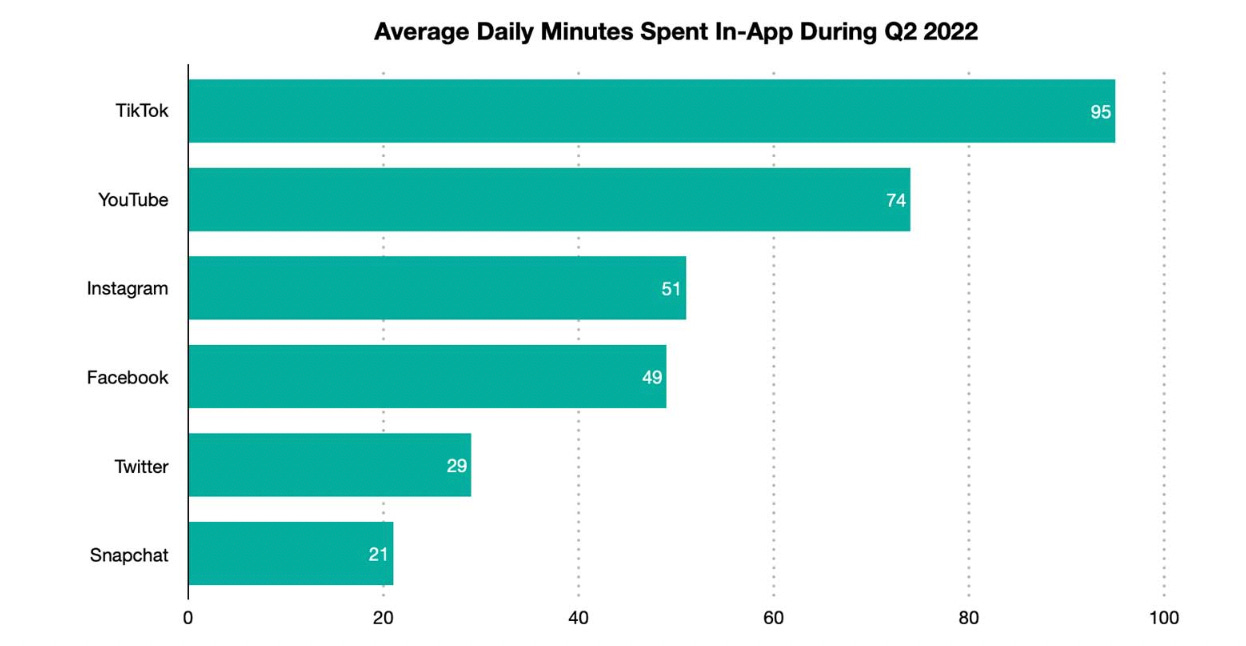

2016, is the year Instagram and Twitter shifted their focus from a time-based feed to an algorithmic-based feed. The introduction of TikTok and short-form videos in 2020 have pulled both of them upwards to the upper right corner - a corner where parasocial relationship scales (the social network doesn’t).

If we simply look at the largest and most profitable niches of social media, they tend to position themselves in the top right corner (i.e. TikTok & Youtube & Instagram). However, if Twitter is going to take on Threads in the race to the top right corner, he has already lost.

However, one possibility where Twitter’s best defence against Threads may be to retreat to that lower left corner: focus on what is happening now, from people you chose to follow. The problem, though, is that while this might win the battle against Threads, it means that Musk will have lost the war when it comes to ever making a return on his $44 billion. In truth, though, that war is already lost: Musk’s lurch for the upper right was probably the best path to reigniting user growth, but if that is the corner that matters then Threads will win.

This Month in the Creator Economy

Microsoft wins FTC fight to acquire Activision Blizzard (Verge)

Fanhouse was acquired by Passes, founder Rosie Ngyuen said that she has lost executive power since 2022, and creators are feeling apprehensive (TechCrunch)

Twitter starts sharing ad revenue with Twitter Blue creators (TechCrunch)

John Green called on his Youtube community to pressure Johnson & Johnson (J&J) into making tuberculosis medication more accessible (Twitter)

Amazon brought in record sales of $12.7 billion on Prime Day, #primeday recorded 57 million views on TikTok with 500 participating creators (TechCrunch)

TikTok partners with FIFA to promote exclusive content from this year’s Women’s World Cup (FIFA)

New York Senator Chuck Schumer asked the Food and Drug Administration to investigate PRIME, Logan Paul and KSI’s sports drink brand (NPR)

Sidemen Sell Out 62,000 Tickets for the 2023 Charity Match, raising over $1 million for charity Teenage Cancer Trust and Rays of Sunshine (Linkedin)

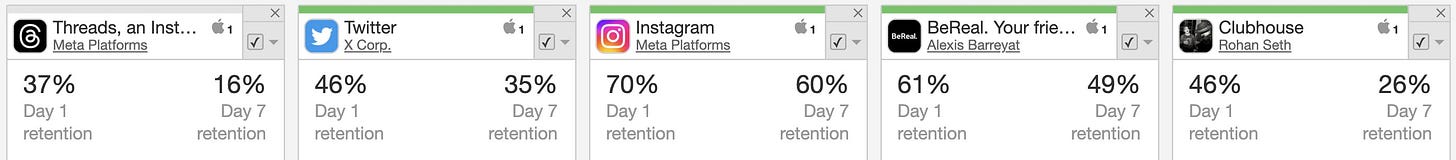

Threads seemed to have the worst D7 retention out of all other comparables

Top Startups You Should Pay Attention To

Retro (Seed, Led by Thrive Capital)

Retro is a photo-sharing app that focuses on social networks, instead of engagement and growth. It was founded by former Instagram employees Nathan Sharp and Ryan Olson. Users could share precedent pictures and videos on their profiles which would disappear in four weeks (instead of Instagram’s 24 hours).

Thatch (Seed, Led by Wave Capital)

Thatch Travel is a platform that enables travel creators to sell interactive itineraries to their followers. Think Gumroad but tailored to travel recommendations. Through Thatch, creators can package their insider knowledge into a simplified itinerary with interactive maps, hyperlinks to local sites, and tips, etc. Today the platform has over 2050 creators, covering 76 countries in the world.

Stan (Seed, Led by Forerunner Ventures)

Stan is a storefront platform for creators. Started as a link-in-bio tool where creators can launch their courses, digital products, and bookings through it. Led by John Hu and Vitalii Dodonov, they have helped creators monetize over $15 million, with 6000 customers at approximately $2.4 million in annual recurring revenue (ARR)